-

Visa Installment Credential helps expand your Buy Now Pay Later options

Visa Installment Credential works anywhere Visa is accepted – reaching customers throughout their journey to help drive scale, customer acquisition and loyalty.

Why Visa Installment Credential (VIC)

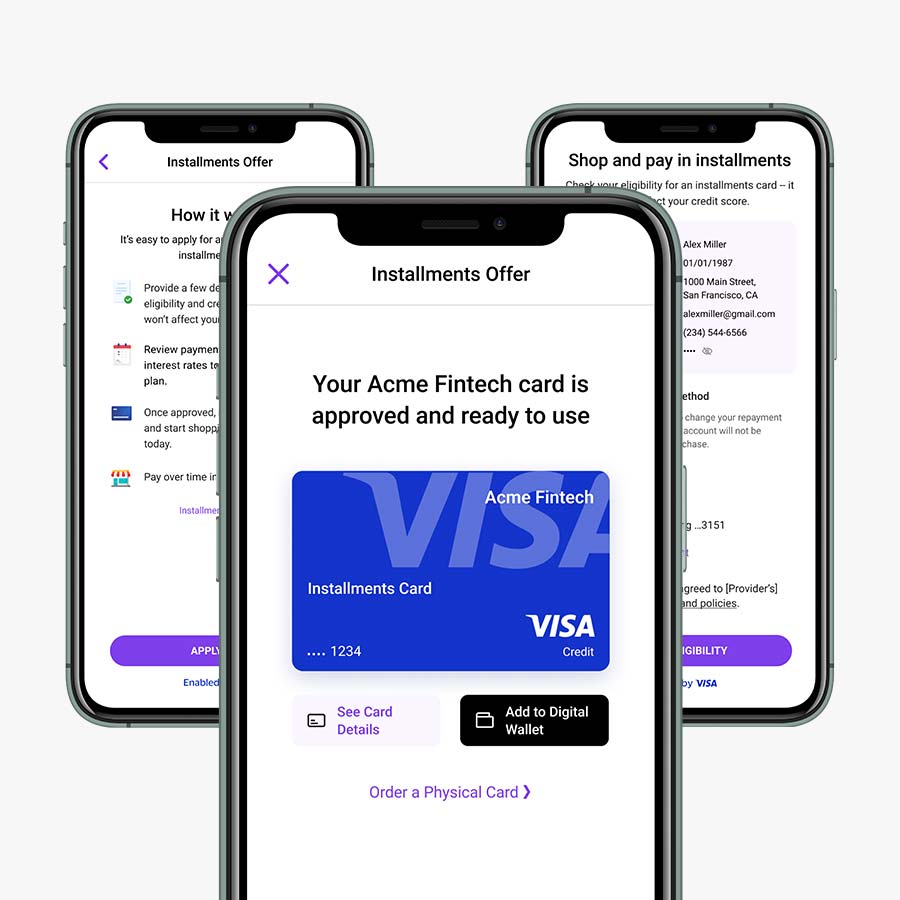

Visa Installment Credential is a physical or digital credential that lets customers make purchases with installments anywhere Visa is accepted. The solution allows your customers to pay in installments by leveraging their credential at checkout, just as they would with a credit or debit card. Also easy to implement, it allows for quick adoption at scale.

Provide consumers with payment flexibility

Expand BNPL use cases throughout the consumer journey, giving them more payment options to help drive scale.

How Visa Installment Credential works

Follow the simple journey from application to auto-drafted installment.

- Customer applies

Customer sees the lender’s offer for a VIC credential payment option. - Lender assesses

Lender can then assess, approve and fund the VIC credential. - Customer sets repayment

Customer links card or account for repayment. - Customer gets Virtual Card

Customer can use credential to complete purchase. - Customer makes purchase

Customer’s transaction is authorized and cleared through VisaNet. - Lender sets auto draft

Lender auto-drafts installment at agreed frequency.

Featured partners

Still have questions?

Get answers in our FAQ.

-

-

VIC is a physical and/or digital credential that allows lenders to offer installment plans to their customers for purchases made anywhere Visa is accepted. Unlike VIS, Merchants don’t need to integrate to Visa Application Programming Interfaces (APIs) for customers to access the installment plans offered by VIC. Credentials supports multi or one-time use transactions. The credential can be used for both card-present (POS) and card-absent (eCommerce) transactions. Its primary use case is for pre-purchase, short tenure (i.e Pay-in-4) plan types (for example, a cardholder selects a pay-in-four-installments plan before making the purchase transaction).

VIS is a suite of APIs and related services and features that enable Participants to provide card-based installment payment solutions to Cardholders. Visa Installment Solutions allows Eligible Cardholders the flexibility to pay for a purchase in equal payments over a defined period. Issuers can offer their Cardholders installment payment options before, during, or post purchase. Merchant Participants, enabled by their Acquirers, can offer Installments payment options to Eligible Cardholders during the purchase experience.

-

-

Effective 15 October 2022, Visa will introduce VIC in Saudi Arabia and the United Arab Emirates only. This new product is a prepaid consumer payment credential that enables installment purchases globally.

Visa expects to make VIC available to issuers in other countries. Please refer to the latest Technical Letters and relevant Visa Business News announcements for the most up-to-date regional availability.

-

-

Similar to standard credential processing, VIC transactions will be authorized for the full purchase amount and settled with the acquirer/merchant in full. The cardholder repays the BNPL Lender as agreed between cardholder and the lender.

-

-

No. Merchants will be able to accept and process Visa Installment Credential transactions like any other Visa product. There will be no integration effort required.

-

-

Connect with your Account Executive to discover program enablement partners from the Visa Ready BNPL Partner Program. Visa clients will be able to directly leverage our Consulting and Analytics team to select their preferred partners, determine product fit, and build their VIC offering to meet their needs.